Compounded annuity formula

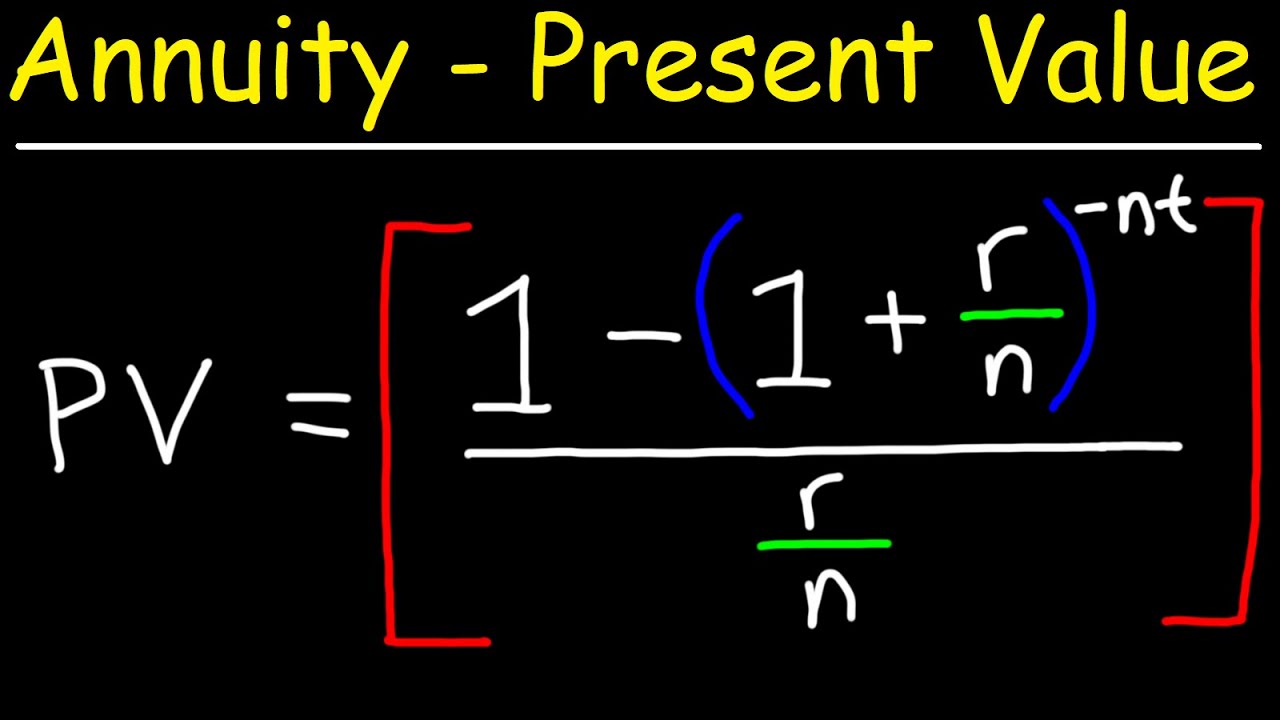

The present value PV of an annuity with continuous compounding formula is used to calculate the initial value of a series of a periodic payments when the rate is continuously compounded. Ad Read the Other Advantages an Income Annuity Provides How You Can Benefit from One Today.

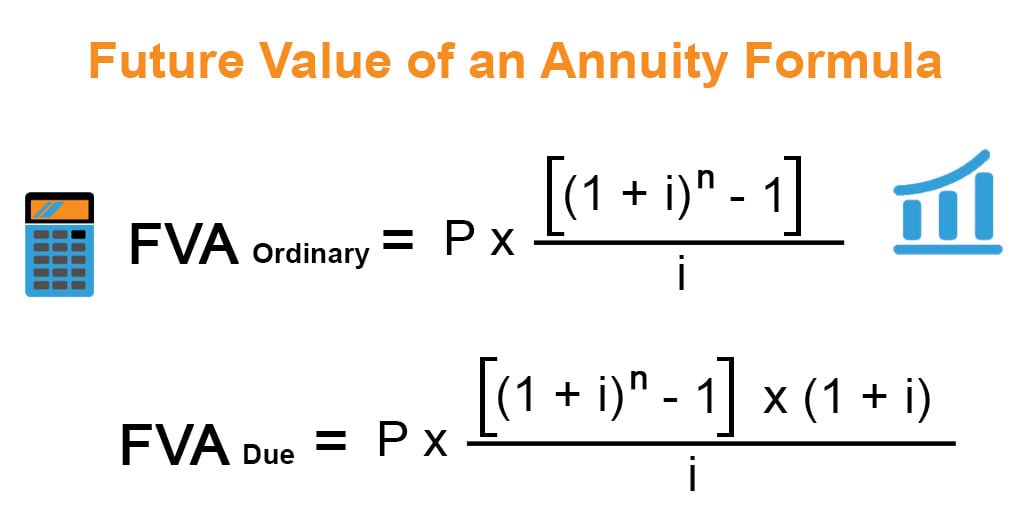

Future Value Of Annuity Formula With Calculator

Compound Interest earns interest on a growing basis since interest is earned on interest in addition to the.

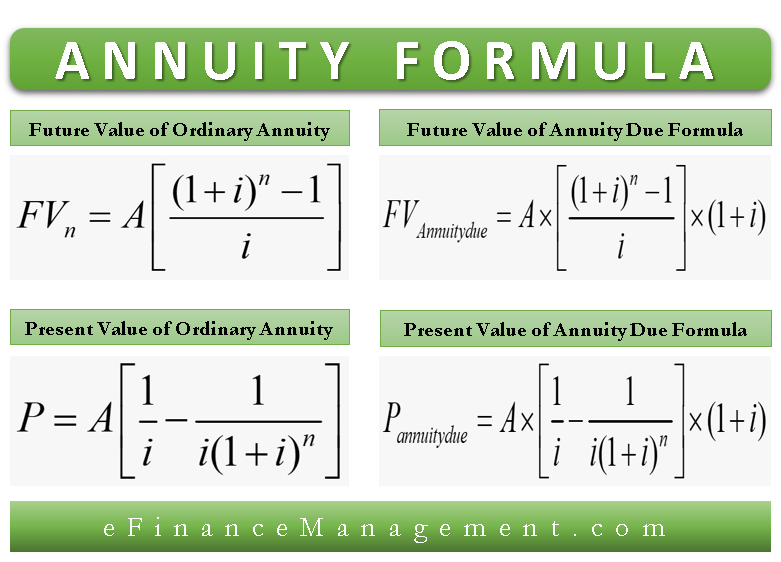

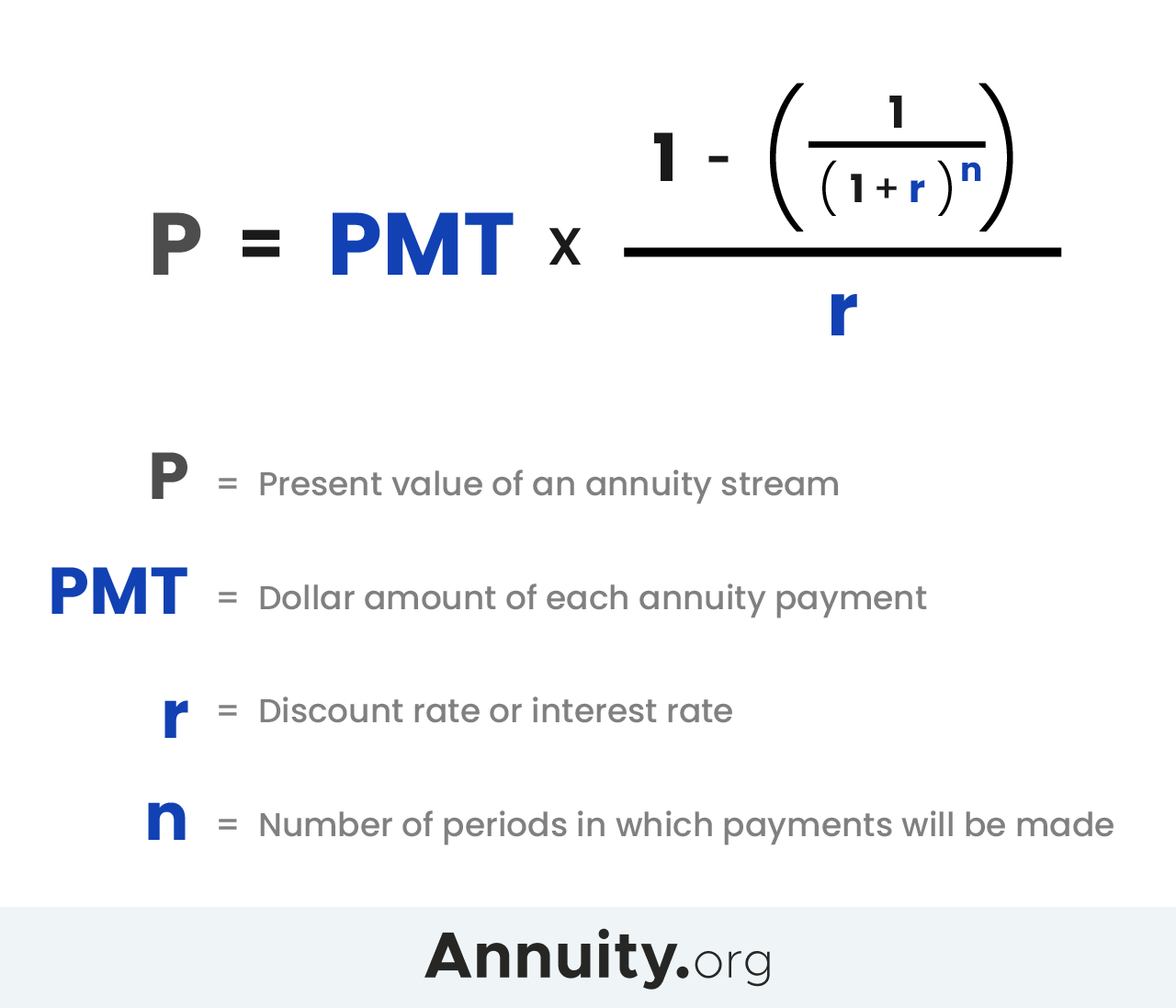

. Where PV present value FV future value PMT payment per period i interest rate in percent per period N number of periods. Want to Learn More About Annuities. Annuity is an investment from which periodic withdrawals are made.

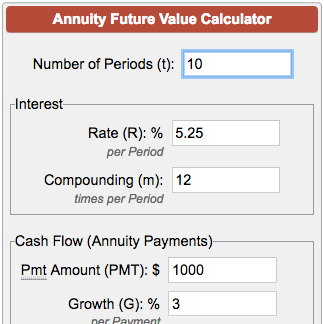

To calculate the compounded annually formula you will need to know the. A Calculator To Help You Decide How a Fixed Annuity Might Fit Into Your Retirement Plan. The sum of cash flows with continuous compounding can be shown as.

FVA CF X. Total amount of principal and interest in future principal amount at present Compound interest. Understand What an Income Annuity is How it Works.

FV 1000 1 008 3 1. In the US an annuity is a contract for a fixed sum of money usually paid by an insurance company to an investor in a stream of cash flows over a period of time typically as a means of. Ad Fixed Annuity Can Provide a Very Secure Tax-Deferred Investment.

Ad Learn More about How Annuities Work from Fidelity. Monthly Compound Interest P 1 R 1212t P. However with any annuity of significant length such a tactic would be impractical and extremely tedious.

Understand What an Income Annuity is How it Works. FVPMT 1i 1iN - 1i. Want to Learn More About Annuities.

The future value of a particular annuity with continuous compounding abbreviated at FVA is calculated using the following annuity formula continuous compounding formula. The future value of annuity with continuous compounding formula is the sum of future cash flows with interest. The compounded annual formula can be used for investments such as savings accounts bonds and stocks.

Monthly Compound Interest 20000 1 1012 1012 20000. PV of an Annuity Due PV of Ordinary Annuity 1i Multiplying the PV of an ordinary annuity with 1i shifts the cash flows one period back towards time zero. Monthly Compound Interest 3414083.

Ad Learn More about How Annuities Work from Fidelity. Ad Read the Other Advantages an Income Annuity Provides How You Can Benefit from One Today. This video explains how to derive the value of an annuity formula using the case when deposits are made annually with interest compounded annuallySite.

Interest may be compounded. Instead we can use the annuity equation as follows.

Pv Of Annuity W Continuous Compounding Formula With Calculator

Future Value Of An Annuity Double Entry Bookkeeping

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities3-f5e4d156c37b4fffb4f150266cea32b1.png)

Calculating Present And Future Value Of Annuities

Fv Of Annuity With Continuous Compounding Formula With Calculator

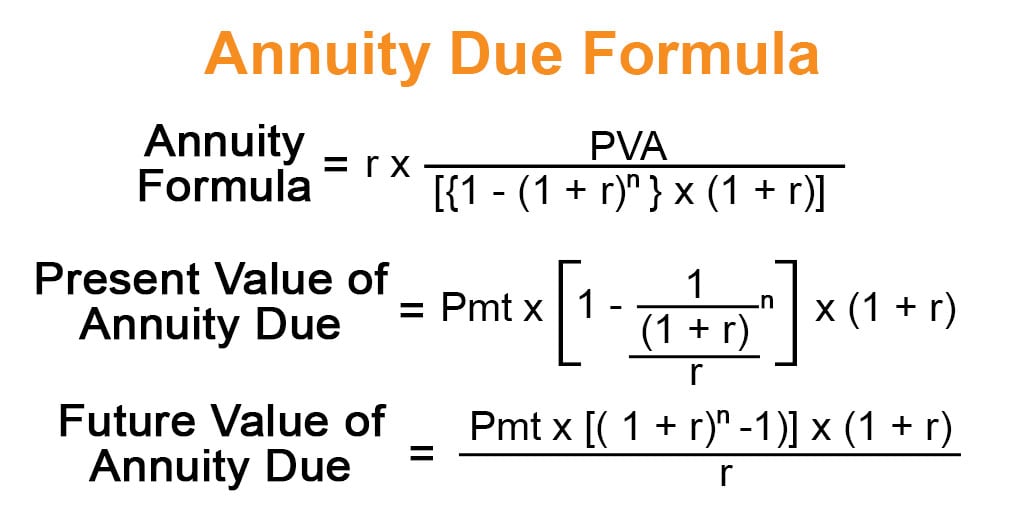

Annuity Due Formula Example With Excel Template

Pv Of Annuity W Continuous Compounding Formula With Calculator

Future Value Of An Annuity Annuity Teaching Mathematics

Future Value Of An Annuity Formula Example And Excel Template

Derive The Value Of An Annuity Formula Compounded Interest Youtube

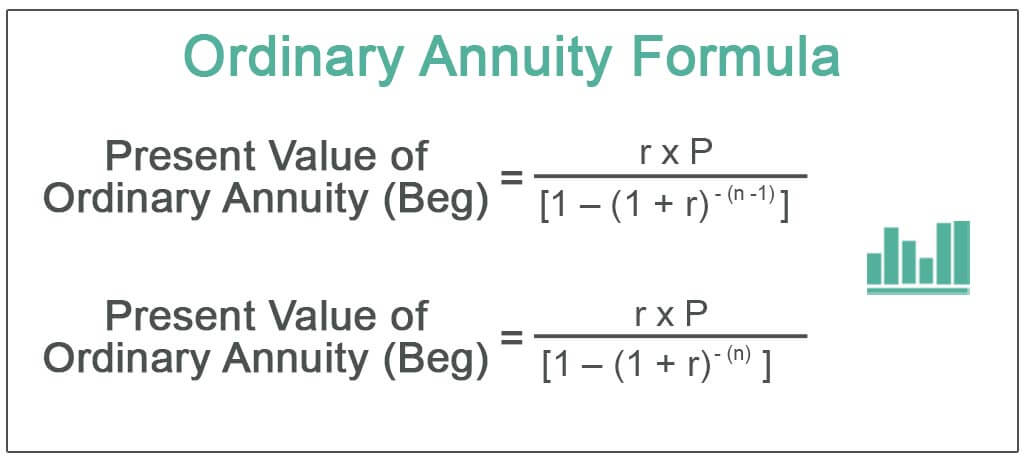

Ordinary Annuity Formula Step By Step Calculation

Annuity Formula Present Future Value Ordinary Due Annuities Efm

Future Value Of Annuity Calculator

How To Calculate The Present Value Of An Annuity Youtube

Present Value Of An Annuity How To Calculate Examples

Annuity Formula What Is Annuity Formula Examples

How To Calculate The Future Value Of An Ordinary Annuity Youtube

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities5-d76f3a6c09a54703afa365a16aff6607.png)

Calculating Present And Future Value Of Annuities